I'm about 100 pages in, and so far I've found the book to be accessible and packed with helpful and thought-provoking historical data. Here's an interesting excerpt from the book (as republished in this interview):

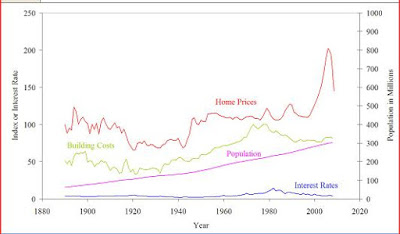

It is true that, for the United States as a whole, real home prices were 66% higher in 2004 than in 1890, according to the index my research assistants and I have put together. But all of that increase occurred in two brief periods: the time right after World War II and since 1998. Other than those two periods, real home prices overall have been mostly flat or declining. Moreover, the overall increase, including the booms, is not very impressive — 0.4% a year.

Why then do so many people have the impression that home prices have done so well? People remember the prior purchase price of a home from long ago and are surprised at the difference between then and now. In closing out the estate of an elderly person, one may be surprised to see that he purchased a house in 1948 for $16,000 and that the estate sold the house in 2004 for $190,000. The appearance is that the investment in the house did extremely well. But the consumer price index rose eightfold between 1948 and 2004, so the real increase in value was only 48%, or less than 1% a year.

Schiller has been updating some of the data and graphs from his book at http://www.irrationalexuberance.com/. It's fascinating to see where stock prices and housing prices are now in relation to where they've been over the past 100 plus years. The image below is his updated graph of real home prices through mid-2008.

4 comments:

Please don't confuse a lack of response with a lack of interest. This stuff is great. What I want to see is a long-term comparrison if you took the same about of money over time and 1) invested in a house (including interest) vs. 2) rent + the stock market. What do you end up with after 30+ years?

I've wondered that too--it really depends on a number of factors, including appreciate of real estate versus the stock market, monthly rent versus monthly mortgage, personal tax situation, etc. If you're really going to live in the same place for 30 years, I suspect it's nearly always better to buy than rent. The NY Times has an excellent rent vs. buy calculator. If you found a similar calculator to calculate your returns on investing the difference between the mortgage and rental costs (minus lost tax benefits), you might be getting close to an answer.

Wouldn't it also depend greatly on what your timing was in buying into the real-estate market and/or stock market? You were telling me that Shiller thinks now is a good time to invest in the stock market because of price-to-earnings ratio... but someone who was doing the same $$$ investment a year or two ago might end up with an entirely different 30-year outcome?

Agreed. Timing does matter. (And just to clarify, I meant "appreciation" not "appreciate" in my prior comment.)

Post a Comment